At the end of this blog, you will clearly understand What is Voucher? Definition and How it is Used in Accounting? along with its different types.

Table of Contents

- Introduction (What is Voucher)

- Definition (Voucher)

- Importance (How it is used in accounting)

- Types of Vouchers with Examples (Journal, Cash, Petty Cash, Cash Memo, Credit Memo)

a. Introduction

All financial documents are recorded in the books of accounts. The documents required for recording transactions in the books of accounts are called source documents and it indicates the nature of transactions and other details regarding its entry. This document is the legal proof of the transaction which is recorded in the books of accounts. e.g. Cash memo received for purchase of machineries for $50,000 cash. The cash memo is a source document. Now for each transaction a documentary evidence is required which is called voucher and it is prepared first.

b. Definition

Voucher is a documentary evidence in support of a business transaction and vouchers are prepared first from the transactions. The vouchers may be of different types for different transaction used in accounting like cash expenses, purchases or sales. e.g. cash vouchers, petty cash vouchers, purchase vouchers and sales vouchers.

- Internal Voucher

When the business is very big and spread over a number of branches, a voucher is prepared for the transfer of cash or goods from one branch to another branch or head office to branch or vice versa is called Internal Voucher. In another situation when things are purchased from groceries or travelling by a taxi, we cannot get a receipt as proof for such a transaction, it is necessary to create a documentary record by preparing a voucher in the organisation which is called Internal Voucher. In short a. voucher which is created by the business itself and signed by payee is called as an Internal Voucher.

- External Voucher

An external voucher is a document received from an outside agency regarding the business transaction. e.g. Cash memo received from the seller for the purchase of stationery or goods, receipt of electricity bill.

c. Importance of Voucher

- A voucher is a documentary evidence of the transaction.

- It is used as a support for ascertainment of profit in taxation matters like income tax, sales tax, excise.

- The vouchers help the auditor to perform his duties efficiently and independently.

- A voucher describes the nature of a transaction.

d. Types of Vouchers with Examples

- Journal Voucher

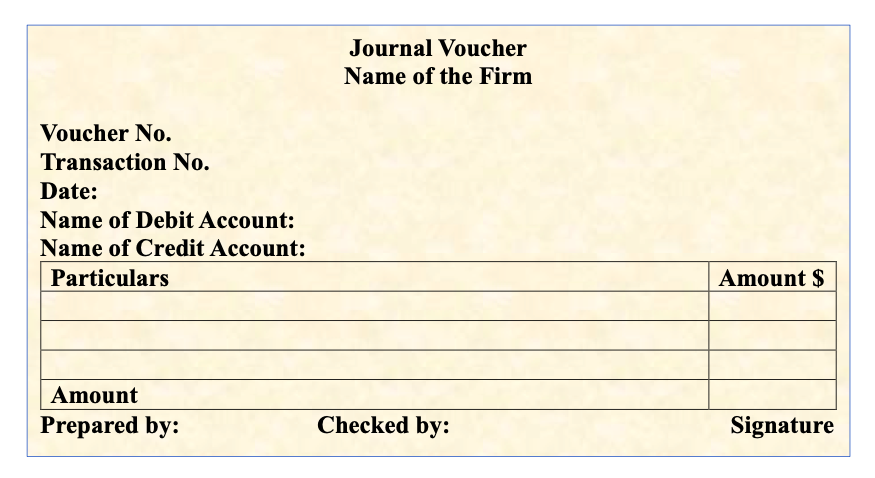

Journal voucher is the basic and original voucher. A journal voucher will include (A) Name of the firm, (B) Voucher No. (C) Transaction No. (D) Date, (E) Name of Debit Account, (F) Name of Credit Account, (G) Particulars and the Amount, (H) Signature of the person preparing the voucher, (I) Signature of the payee, (J) Signature of the person authorizing the payment.

Specimen of the journal voucher will be shown below.

- Cash Voucher

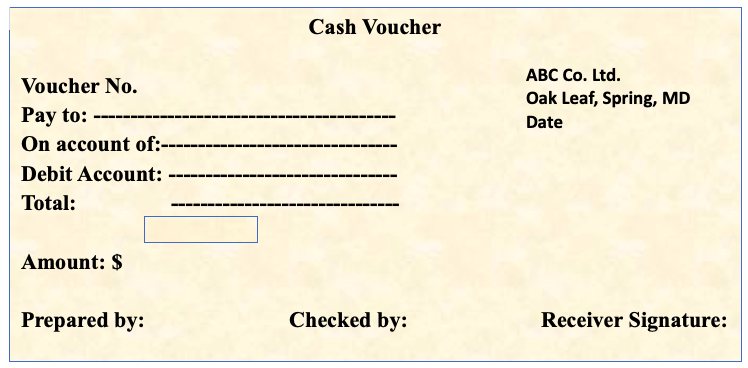

Any purchase or transaction in cash, one should prepare a cash voucher. If a purchase is made and a documents was obtained from the supplier or vendor then the document itself can be treated as a voucher. A firm can prepare an internal voucher as well for the payment and attach the supported document received from the supplier.

A cash voucher contains the following, (A) Name and address of the business, (B) Voucher No., (C) Date, (D) Name of the payee, (E) Details of the payment, (F) Account head, (G) Amount in figures, (H) Signature of the person preparing the voucher, (I) Signature of the payee and (J) Signature of the person authorizing the payment.

The cash voucher is printed and the date of the payment is mentioned on the top also the serial number of the voucher is entered. A cashier in a firm prepared the voucher and the head of accounts, usually an accountant or finance officer checks and reviews the document. Some organisations has a policy that if the amount of voucher exceeds $100 a stamp is required before signing the voucher. An external document is also attached with it if available.

Specimen of the Cash voucher will be shown below.

- Petty Cash Voucher

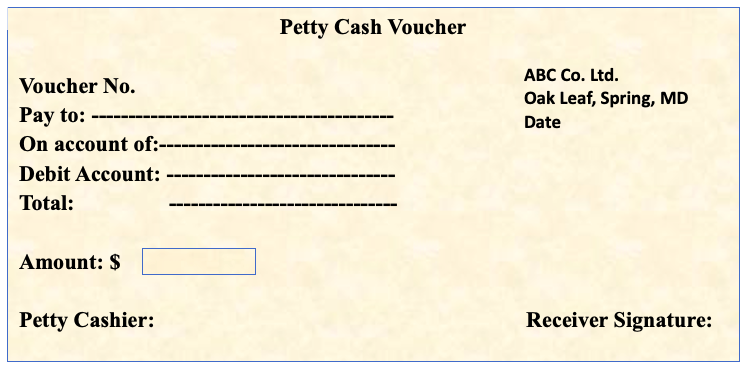

In any business the expenses in cash may be different. Some of expenses are very small in amount but are incurred very frequently. e.g. transport charges, Taxi fares, etc. Such small and frequent spendings are called Petty cash expenses. A petty cashier is appointed to make such payments. A petty Cashier must a get a documentary proof before making the payment, this documentary proof is called Petty Cash Voucher.

The Petty Cash Voucher is as similar as Cash Voucher. The difference is between the expenditure and the frequency of expenditures. For that reason a separate Petty Cash Book is maintained and the vouchers are marked specifically as Petty Cash Vouchers.

A Petty Cash contains the following. (A) Name and address of the business, (B) Voucher Number, (C) Date, (D) Name of the payee, (E) Details of the payment, (F) Account Head, (G) Amount, (H) Signature of the person preparing the voucher, (I) Signature of the payee, (J) Signature of the person authorising the payment. For petty cash voucher the Petty Cashier is authorised to sign the voucher. Each voucher is serial numbered when printed.

Specimen of the Cash voucher will be shown below.

- Cash Memo

This document indicates the description of goods supplied, rate, quantity, amount and a receipt of the payment for the sale. The seller issues the cash memo, when the goods are sold for cash. Each cash memo has a duplicate copy. The seller keeps the carbon copy and the original is given to the customer. A cash memo is not a receipt so the seller will not stamp the memo. It is a reliable record of cash sales, on the basis of cash memos, sales are recorded in the cash book.

A cash memo contains the following items. (A) Name and address of the seller, (B) Number of cash memo, (C) Date, (D) Name and address of the purchaser, (E) Details about the purchase order, (F) Details of goods supplied, e.g. quantity, (G) Rates, (H) Other Charges, e.g. sales tax, transport, packing, (I) Signature of the seller.

- Credit Memo

When the goods are sold on credit, the supplier issues a credit memo. It is also called an invoice or bill. The supplier will get the payment from the customer after the period of credit. The supplier keeps the record of the name and address of the customers. The period of credit and due dates is mentioned in credit memo or bill. These bills are printed and serially numbered. An organisation can identify their credit sales from these bills or invoices.

A credit memo is a statement sent by a seller to the buyer whose signature is obtained in the copy and it is accepted by the buyer that the amount mentioned in credit memo and the amount due to seller. On the basis of credit memo, credit sales are recorded by the seller in his books of accounts. The purchaser on the other hand records credit purchases in his purchase book.

A credit memo contains the following. (A) Name, address and other details of the seller, (B)Invoice Number, (C) Date, (D) Name and address of the purchaser, (E) Details about the purchase order, (F) Terms of delivery, (G) Details of goods supplied with description, (H) Rates applicable, (I) other charges e.g. sales tax, transport, packing. (J) Signature of the seller.

If you want to learn about the accounting concepts, conventions and principles along with examples, please refer to the link Accounting Concepts, Conventions and Principles

[…] Step-by-Step Guide with Examples What is WACC, Definition, Importance and Usage What is Voucher? Definition and How it is Used in Accounting? Accounting Concepts, Conventions and Principles 18 Jan 2025, […]