What is Cashbook Reconciliation, and its step-by-step guide?

Mastering Cashbook reconciliation is the process of matching the cash transactions recorded in a company’s cashbook with the actual cash balance. It ensures that all cash receipts and payments are correctly accounted for and helps detect errors, fraud, or discrepancies.

Steps in Cashbook Reconciliation:

- Compare Opening Balances: Ensure that the cashbook’s opening balance matches the actual cash in hand.

- Verify Cash Receipts: Check all cash receipts against invoices, sales records, and bank deposits.

- Match Cash Payments: Ensure that payments made are correctly recorded in the cashbook.

- Identify Discrepancies: Look for missing transactions, duplicate entries, or errors in recording.

- Adjust for Errors: Make necessary adjustments to reconcile the differences.

- Prepare a Reconciliation Statement: Document the process to track corrections and maintain financial accuracy.

Example of Cashbook Reconciliation:

- Opening cash balance: $5,000

- Cash received during the period: $3,500

- Cash payments made: $2,800

- Expected closing balance: $5,700

- Actual cash balance: $5,500

- Discrepancy: $200 (to be investigated and adjusted)

Difference Between Cashbook and Bank Book Reconciliation

| Aspect | Cashbook Reconciliation | Bank Book Reconciliation |

|---|---|---|

| Definition | Matching cashbook records with actual cash on hand. | Matching bank statements with company records. |

| Objective | Ensures physical cash and recorded cash match. | Ensures bank transactions and records align. |

| Discrepancies | Due to theft, counting errors, or unrecorded cash. | Due to timing differences, bank charges, or uncleared checks. |

| Adjustments | Correcting errors in recording cash transactions. | Adjusting for outstanding checks, deposits in transit, or errors. |

| Statement Used | Cash Count Sheet | Bank Reconciliation Statement |

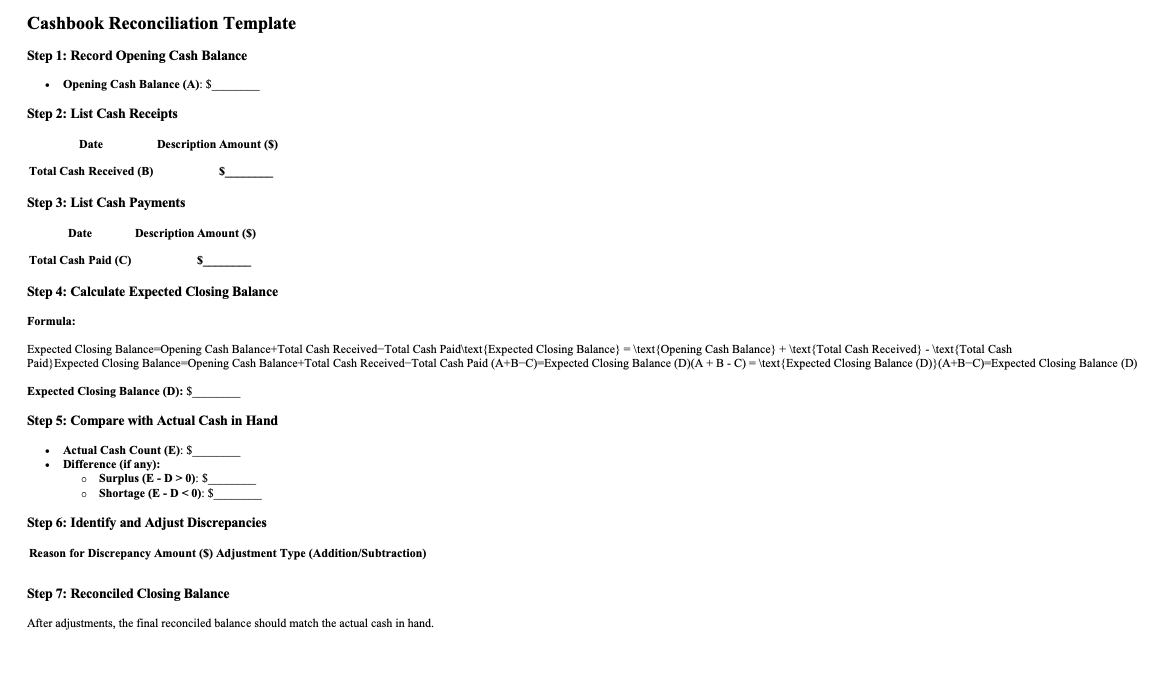

Cashbook Reconciliation Template

Step 1: Record Opening Cash Balance

- Opening Cash Balance (A): $________

Step 2: List Cash Receipts

| Date | Description | Amount ($) |

|---|---|---|

| Total Cash Received (B) | $________ |

Step 3: List Cash Payments

| Date | Description | Amount ($) |

|---|---|---|

| Total Cash Paid (C) | $________ |

Step 4: Calculate Expected Closing Balance

Formula:

Expected Closing Balance=Opening Cash Balance+Total Cash Received−Total Cash Paid\text{Expected Closing Balance} = \text{Opening Cash Balance} + \text{Total Cash Received} – \text{Total Cash Paid}Expected Closing Balance=Opening Cash Balance+Total Cash Received−Total Cash Paid (A+B−C)=Expected Closing Balance (D)(A + B – C) = \text{Expected Closing Balance (D)}(A+B−C)=Expected Closing Balance (D)Expected Closing Balance (D): $________

Step 5: Compare with Actual Cash in Hand

- Actual Cash Count (E): $________

- Difference (if any):

- Surplus (E – D > 0): $________

- Shortage (E – D < 0): $________

Step 6: Identify and Adjust Discrepancies

| Reason for Discrepancy | Amount ($) | Adjustment Type (Addition/Subtraction) |

|---|---|---|

Step 7: Reconciled Closing Balance

After adjustments, the final reconciled balance should match the actual cash in hand.

How to create Cash Book Reconciliation Manually in Excel?

Step 1: Create Four Sheets

- Summary

- Columns: Step | Amount ($)

- Rows:

- Opening Cash Balance (A)

- Total Cash Received (B)

- Total Cash Paid (C)

- Expected Closing Balance (A + B – C)

- Actual Cash Count (E)

- Difference (E – D)

- Cash Receipts

- Columns: Date | Description | Amount ($)

- Cash Payments

- Columns: Date | Description | Amount ($)

- Discrepancies

- Columns: Reason for Discrepancy | Amount ($) | Adjustment Type (Add/Subtract)

Step 2: Apply Formulas

- In the Summary Sheet, use formulas for calculations:

- Expected Closing Balance =

Opening Balance + Total Receipts - Total Payments - Difference =

Actual Cash Count - Expected Closing Balance

- Expected Closing Balance =

Conclusion

Mastering cashbook reconciliation helps maintain financial integrity, detect errors, and prevent fraud. While similar to bank reconciliation, cashbook reconciliation focuses solely on physical cash transactions, whereas bank reconciliation deals with transactions passing through the bank.

Now that you know how to prepare and calculate Cash Book Reconciliation, you might also want to read about Mastering Bank Reconciliation: Step-by-Step Guide with Examples & Key Differences.

[…] Mastering Cashbook Reconciliation: Step-by-Step Guide with Examples Mastering Bank Reconciliation: Step-by-Step Guide with Examples What is WACC, Definition, Importance and Usage What is Voucher? Definition and How it is Used in Accounting? Accounting Concepts, Conventions and Principles 18 Jan 2025, Sat […]