Introduction

A trial balance is a critical tool in the accounting process that helps ensure the accuracy of financial records. It serves as a checkpoint to verify that total debits equal total credits, which is essential for preparing financial statements. In this blog, we will discuss how to prepare a trial balance, its importance, purpose, specimen format, and examples.

What is a Trial Balance?

A trial balance is a statement that lists all ledger account balances at a specific point in time. It helps accountants detect errors and ensures that transactions are recorded correctly. If the total of debit balances does not match the total of credit balances, it signals an error that needs correction.

Importance of a Trial Balance

A trial balance plays a vital role in the accounting process for the following reasons:

- Error Detection – It helps identify mistakes such as incorrect postings or omissions.

- Financial Statement Preparation – A trial balance serves as a basis for preparing financial statements like the income statement and balance sheet.

- Accuracy Check – It ensures that transactions follow the double-entry accounting principle.

- Account Review – Accountants can use it to analyze and review financial data before finalizing reports.

Purpose of a Trial Balance

The primary purposes of preparing a trial balance include:

- Ensuring the arithmetical accuracy of accounts.

- Summarizing all ledger balances in one statement.

- Assisting in financial statement preparation.

- Detecting accounting errors before finalizing reports.

Steps to Prepare a Trial Balance

- List all ledger accounts – Extract all balances from the general ledger.

- Classify balances – Separate them into debit and credit columns.

- Record balances in a tabular format – Ensure each account is correctly entered.

- Total the debit and credit columns – The totals should match.

- Verify and correct errors – If there is a discrepancy, review ledger entries to locate and rectify the mistake.

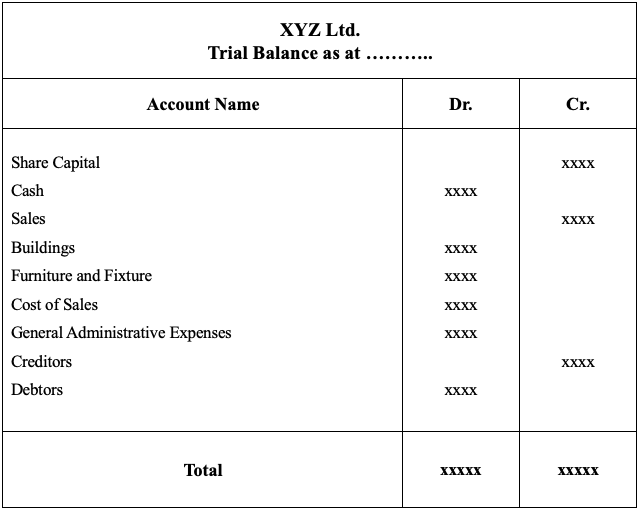

Specimen of Trial Balance

Specimen Format of a Trial Balance

Below is a sample format of a trial balance:

| Account Name | Debit (Amount) | Credit (Amount) |

|---|---|---|

| Cash Account | 10,000 | |

| Sales Revenue | 15,000 | |

| Rent Expense | 2,000 | |

| Accounts Payable | 5,000 | |

| Salaries Expense | 3,000 | |

| Capital Account | 10,000 | |

| Total | 15,000 | 15,000 |

How to prepare a trial balance with examples is the next topic we will discuss?

Example of a Trial Balance Preparation

Let’s assume XYZ Ltd. has the following transactions:

- Invested $20,000 in the business.

- Purchased inventory worth $5,000.

- Earned revenue of $8,000.

- Paid rent of $2,000.

- Paid salaries of $3,000.

The trial balance would look like this:

| Account Name | Debit (Amount) | Credit (Amount) |

| Cash Account | 20,000 | |

| Inventory | 5,000 | |

| Revenue Earned | 8,000 | |

| Rent Expense | 2,000 | |

| Salaries Expense | 3,000 | |

| Owner’s Equity | 20,000 | |

| Total | 30,000 | 30,000 |

Since the total debits and credits match, the books are considered accurate.

Conclusion

A trial balance is a crucial step in the accounting process, ensuring that transactions are recorded accurately before financial statements are prepared. By following the steps outlined above, businesses can maintain proper records and detect errors promptly. Ensuring a balanced trial balance helps streamline financial reporting and improve decision-making for businesses.

You’ve learned about Trial Balance; now take the next step by reading our post on Ledger vs. Journal: Understanding the Backbone of Accounting.

[…] Depreciation: Definition, Types, Importance, and Examples Mastering the Trial Balance: A Step-by-Step Guide with Examples Ledger vs. Journal: Understanding the Backbone of Accounting Journal Entries Explained: A […]