What is Depreciation?

Depreciation is the systematic allocation of the cost of a tangible fixed asset over its useful life. Businesses use depreciation to account for the reduction in value of an asset due to wear and tear, obsolescence, or usage. Consequently, this helps match the expense with the revenue generated by the asset, providing a more accurate financial picture.

Types of Depreciation

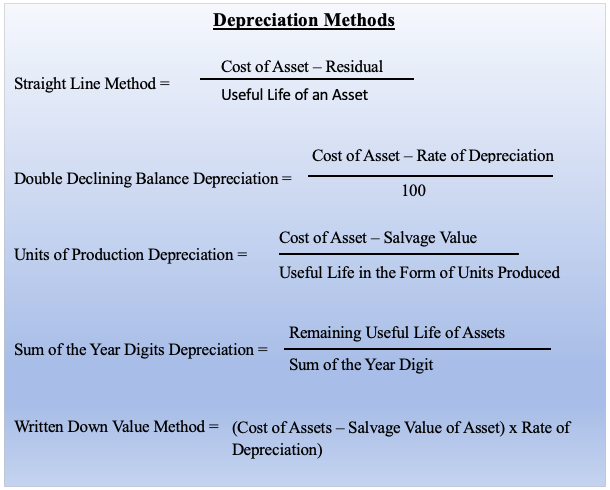

There are several methods to calculate depreciation, each serving different financial and tax planning needs. Below are the most common types:

1. Straight-Line Depreciation

This method spreads the cost of an asset evenly over its useful life. Formula:

Example: For instance, a machine costing $10,000 with a salvage value of $2,000 and a useful life of 5 years would have an annual depreciation expense of:

Industry Example: In the manufacturing sector, machinery such as CNC machines depreciate over time due to regular wear and tear. Therefore, the straight-line depreciation method is a common choice.

2. Declining Balance Depreciation

This method applies a fixed percentage to the remaining book value of the asset each year. Formula:

Example: For example, if an asset costs $5,000 and has a 20% depreciation rate, the first-year depreciation would be:

Industry Example: In the tech industry, laptops and servers rapidly lose value. As a result, declining balance depreciation is ideal to account for higher early-year depreciation.

3. Units of Production Depreciation

This method bases depreciation on the usage of the asset rather than time. Formula:

Example: To illustrate, a truck costing $50,000 with a salvage value of $5,000 and an estimated mileage of 200,000 miles is used for 10,000 miles in a year.

Industry Example: In logistics and transportation, vehicles such as delivery trucks are often depreciated based on mileage or hours used. Consequently, the units of production method is widely utilized.

4. Sum-of-the-Years’ Digits (SYD) Depreciation

This method accelerates depreciation by applying a fraction to the asset’s depreciable base. Formula:

Industry Example: In the aviation industry, aircraft components and engines depreciate faster in earlier years due to intensive usage. Therefore, the SYD depreciation method is often preferred.

5. Written Down Value (WDV) Method

This method applies a fixed depreciation rate to the asset’s book value at the beginning of each year, resulting in higher depreciation expenses in earlier years and decreasing over time.

Formula:

Example: For instance, a machine costs $10,000 with a depreciation rate of 20% per year. The depreciation for the first three years would be calculated as follows:

- Year 1: $10,000 × 20% = $2,000 (Book Value after Year 1 = $8,000)

- Year 2: $8,000 × 20% = $1,600 (Book Value after Year 2 = $6,400)

- Year 3: $6,400 × 20% = $1,280 (Book Value after Year 3 = $5,120)

Industry Example: In the automobile industry, companies use the WDV method to depreciate vehicles, as they lose a significant portion of their value in the initial years of use. Hence, this method provides a more realistic depreciation approach.

Importance of Depreciation

- Accurate Financial Reporting: Ensures expenses are matched with revenues for better profitability analysis.

- Tax Benefits: Allows businesses to reduce taxable income, thereby lowering tax liabilities.

- Asset Replacement Planning: Helps businesses set aside funds for future asset purchases.

- True Asset Valuation: Depicts the current value of assets in financial statements, leading to more informed financial decisions.

Depreciation in Financial Statements

Depreciation is recorded in the income statement as an expense and in the balance sheet as accumulated depreciation, reducing the book value of assets. As a result, this provides a clearer financial picture for stakeholders.

Conclusion

In summary, understanding depreciation is crucial for businesses to maintain accurate financial records, optimize tax planning, and make informed decisions regarding asset investments. Given these points, choosing the right depreciation method depends on the nature of the asset and the company’s financial goals.

Now that you know how to calculate depreciation, you might also want to read about Mastering the Trial Balance: A Step-by-Step Guide with Examples.

Would you like to explore industry-specific depreciation examples or tax implications in your next blog post? Let us know in the comments!

[…] and Provisions in Accounting: Meaning, Types, and Key Differences Understanding Depreciation: Definition, Types, Importance, and Examples Mastering the Trial Balance: A Step-by-Step Guide with Examples Ledger vs. Journal: […]