What is Financial Management?

Financial management is the strategic planning, organizing, directing, and controlling of financial resources to achieve an organization’s objectives efficiently. It involves making crucial financial decisions related to investment, financing, and dividends to maximize profits and ensure long-term sustainability.

Types of Financial Management

Financial management can be classified into three main types:

- Capital Budgeting (Investment Decisions): This involves selecting the best long-term investment projects to ensure optimal growth and profitability. Examples include purchasing new equipment, expanding operations, and investing in new technologies.

- Capital Structure (Financing Decisions): This focuses on determining the best mix of debt and equity financing. The goal is to balance risk and cost while ensuring financial stability. For example, a company may choose to finance a new project through bank loans or issuing shares.

- Working Capital Management: This involves managing short-term assets and liabilities to ensure smooth daily operations. Key aspects include maintaining adequate cash flow, managing accounts receivable and payable, and optimizing inventory levels.

Importance of Financial Management

Effective financial management is crucial for businesses and individuals for several reasons:

- Ensures Financial Stability: Proper management helps businesses and individuals maintain liquidity and avoid financial crises.

- Enhances Profitability: Well-planned financial strategies optimize revenue generation and cost control.

- Aids in Decision-Making: Sound financial analysis supports informed decision-making for investments, expansions, and risk management.

- Facilitates Growth & Expansion: Efficient financial management enables businesses to expand their operations and explore new markets.

- Improves Investor Confidence: Transparent financial practices attract investors and build trust among stakeholders.

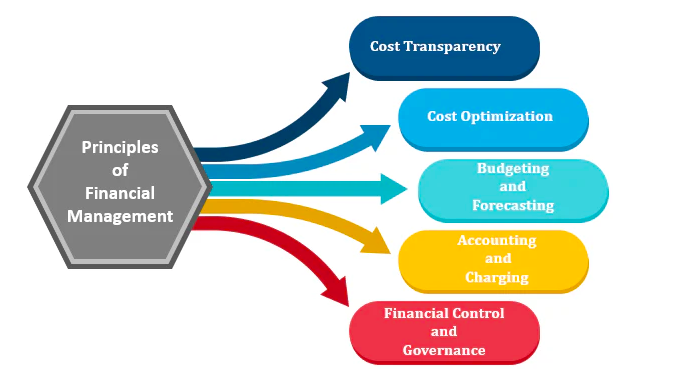

Principles of Financial Management

To ensure sound financial management, businesses and individuals should adhere to key principles, including:

- Consistency: Financial policies and practices should be consistent over time to maintain stability and predictability.

- Accountability: Financial transactions and decisions should be well-documented and transparent to ensure responsibility and credibility.

- Risk Management: Identifying and mitigating financial risks is crucial for safeguarding assets and ensuring long-term sustainability.

- Profitability & Growth: Financial management should aim to enhance profitability while ensuring steady business growth.

- Liquidity Management: Maintaining adequate cash flow ensures smooth operations and prevents financial distress.

- Sustainability: Financial decisions should be made with long-term success and sustainability in mind.

- Budgeting & Control: Creating a well-structured budget and monitoring expenses help in managing finances efficiently.

Usage of Financial Management in Various Industries

Financial management plays a critical role in different industries by ensuring efficient resource allocation and risk mitigation. Some industry-specific applications include:

- Healthcare: Hospitals use financial management to budget for medical equipment, manage insurance claims, and optimize operational costs.

- Manufacturing: Companies manage production costs, inventory, and capital expenditures to maximize efficiency and profitability.

- Technology: Tech firms allocate funds for research and development (R&D), marketing, and scaling operations globally.

- Retail: Retail businesses manage cash flow, supplier payments, and customer pricing strategies to stay competitive.

- Banking & Finance: Banks leverage financial management to ensure regulatory compliance, optimize lending strategies, and maximize shareholder returns.

Real-World Industry Examples

- Apple Inc.: Apple effectively manages its financial resources through strategic investments in research and development (R&D) and efficient capital allocation. The company’s cash reserves and investment strategies contribute to its market dominance.

- Tesla: Tesla balances debt and equity financing to fund innovation and expansion into new markets. It also utilizes government subsidies and tax incentives to manage costs.

- Amazon: Amazon optimizes working capital management by maintaining low inventory costs through just-in-time supply chain strategies.

- Starbucks: Starbucks employs effective financial management to budget for global expansion while maintaining profitability through pricing strategies and customer loyalty programs.

- Coca-Cola: The beverage giant strategically invests in marketing and international expansion while maintaining a strong capital structure with manageable debt levels.

Key Differences Between Financial Management and Other Related Concepts

| Aspect | Financial Management | Accounting | Financial Planning |

|---|---|---|---|

| Focus | Managing financial resources | Recording and reporting financial transactions | Creating strategies for future financial goals |

| Decision-Making | Includes investment, financing, and risk decisions | Primarily focuses on compliance and reporting | Emphasizes goal-setting and budgeting |

| Time Frame | Both short-term and long-term | Historical data and current position | Mostly future-oriented |

| Examples | Allocating capital, controlling costs | Preparing financial statements | Retirement and investment planning |

Conclusion

Financial management is an essential practice for businesses and individuals aiming to achieve financial success. By understanding its types, importance, principles, applications, and real-world examples, one can make informed decisions that lead to financial stability, growth, and sustainability. Whether managing corporate finances or personal wealth, sound financial management is key to long-term prosperity.

You’ve learned about financial management; now take the next step by reading our post on Preparation of Final Accounts: A Complete Guide with Examples.