Introduction

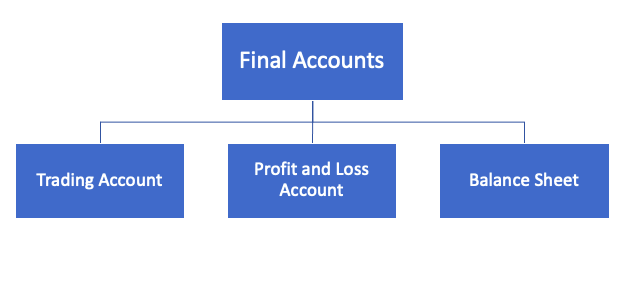

Final accounts are financial statements prepared at the end of an accounting period to ascertain a business’s financial position and profitability. The complete guide for the preparation of final accounts typically includes the Trading Account, Profit and Loss Account, and Balance Sheet. Preparation of final accounts helps stakeholders make informed financial decisions.

Components of Final Accounts

- Trading Account – Determines gross profit or loss.

- Profit & Loss Account – Calculates net profit or loss.

- Balance Sheet – Presents the financial position of the business.

1. Trading Account

The Trading Account is prepared to ascertain the gross profit or gross loss of a business.

Format of Trading Account

| Particulars | Amount (Dr) | Amount (Cr) |

|---|---|---|

| Opening Stock | XX | |

| Add: Purchases | XX | |

| Less: Purchase Returns | (XX) | |

| Add: Direct Expenses | XX | |

| Less: Goods Distributed as Free Samples | (XX) | |

| Less: Closing Stock | (XX) | |

| Sales | XX | |

| Less: Sales Returns | (XX) | |

| Gross Profit (balancing figure) | XX |

Example:

ABC Ltd. has the following details:

- Opening Stock: $20,000

- Purchases: $50,000

- Purchase Returns: $5,000

- Direct Expenses: $10,000

- Goods Distributed as Free Samples: $2,000

- Closing Stock: $15,000

- Sales: $80,000

- Sales Returns: $5,000

Solution:

| Particulars | Amount (Dr) | Amount (Cr) |

| Opening Stock | 20,000 | |

| Add: Purchases | 50,000 | |

| Less: Purchase Returns | (5,000) | |

| Add: Direct Expenses | 10,000 | |

| Less: Goods Distributed as Free Samples | (2,000) | |

| Less: Closing Stock | (15,000) | |

| Sales | 80,000 | |

| Less: Sales Returns | (5,000) | |

| Gross Profit | 23,000 |

2. Profit & Loss Account

The Profit & Loss Account determines the net profit or net loss of a business by deducting indirect expenses from gross profit.

Format of Profit & Loss Account

| Particulars | Amount (Dr) | Amount (Cr) |

| Gross Profit (from Trading Account) | XX | |

| Add: Other Incomes | XX | |

| Less: Operating Expenses | XX | |

| Less: Bad Debts | XX | |

| Less: Reserve for Doubtful Debts | XX | |

| Less: Provision for Discount on Debtors | XX | |

| Add: Accrued Income | XX | |

| Less: Pre-received Income | XX | |

| Net Profit (balancing figure) | XX |

Example:

Using the previous gross profit of $23,000, consider:

- Rent: $5,000

- Salaries: $10,000

- Depreciation: $2,000

- Bad Debts: $1,000

- Reserve for Doubtful Debts: $1,500

- Provision for Discount on Debtors: $500

- Accrued Income: $2,000

- Pre-received Income: $1,000

- Other Income: $3,000

Solution:

| Particulars | Amount (Dr) | Amount (Cr) |

| Gross Profit | 23,000 | |

| Add: Other Income | 3,000 | |

| Add: Accrued Income | 2,000 | |

| Rent | 5,000 | |

| Salaries | 10,000 | |

| Depreciation | 2,000 | |

| Bad Debts | 1,000 | |

| Reserve for Doubtful Debts | 1,500 | |

| Provision for Discount on Debtors | 500 | |

| Pre-received Income | 1,000 | |

| Net Profit | 8,000 |

3. Balance Sheet

The Balance Sheet provides a snapshot of the business’s financial position by listing its assets and liabilities.

Format of Balance Sheet

| Liabilities | Amount | Assets | Amount |

| Capital | XX | Fixed Assets | XX |

| Add: Net Profit | XX | Current Assets | XX |

| Less: Drawings | (XX) | ||

| Long-term Liabilities | XX | ||

| Current Liabilities | XX | ||

| Provision for Discount on Creditors | XX | ||

| Total Liabilities | XX | Total Assets | XX |

Example:

- Capital: $50,000

- Net Profit: $8,000

- Drawings: $3,000

- Loan: $10,000

- Creditors: $15,000

- Provision for Discount on Creditors: $1,000

- Fixed Assets: $40,000

- Current Assets: $41,000

Solution:

| Liabilities | Amount | Assets | Amount |

| Capital | 50,000 | Fixed Assets | 40,000 |

| Add: Net Profit | 8,000 | Current Assets | 41,000 |

| Less: Drawings | (3,000) | ||

| Loan | 10,000 | ||

| Creditors | 15,000 | ||

| Provision for Discount on Creditors | 1,000 | ||

| Total Liabilities | 81,000 | Total Assets | 81,000 |

Conclusion

Final accounts are crucial for assessing the financial health of a business. The Trading Account identifies gross profit or loss, the Profit & Loss Account determines net profit or loss (considering bad debts, provision for discounts, accrued and pre-received income), and the Balance Sheet presents the financial position. Proper preparation of these statements helps businesses make informed financial decisions. This comprehensive guide helps businesses in preparation of final accounts in a complete and sound manner.

You’ve learned how to prepare final accounts; now take the next step by reading our post on Reserves and Provisions in Accounting: Meaning, Types, and Key Differences.

[…] Management: Meaning, Types and Key Differences Preparation of Final Accounts: A Complete Guide with Examples Reserves and Provisions in Accounting: Meaning, Types, and Key Differences Understanding […]