Reserves play a crucial role in financial management, helping businesses maintain financial stability and meet future obligations. In this blog, we will explore the meaning, objectives, types, and examples of reserves in accounting, as well as the concept of provisions and their differences from reserves. Reserves and Provisions in accounting both play vital role.

What are Reserves in Accounting?

Reserves are portions of a company’s profits that are set aside for specific or general purposes rather than being distributed as dividends. They act as a financial cushion, ensuring businesses can handle uncertainties, expansions, or obligations without financial strain. Therefore, reserves are essential for a company’s long-term financial health.

Objectives of Reserves

The primary objectives of reserves include:

- Financial Stability: Helps in maintaining a solid financial position during unforeseen circumstances.

- Future Growth and Expansion: Assists in funding business expansion without depending solely on external financing.

- Meeting Future Liabilities: Ensures funds are available to meet future contingencies, such as asset depreciation or dividend payments.

- Legal and Statutory Compliance: Some reserves are legally required to be maintained by businesses under regulatory frameworks.

- Equalizing Dividends: Companies can maintain a steady dividend policy by using reserves in less profitable years.

Types of Reserves

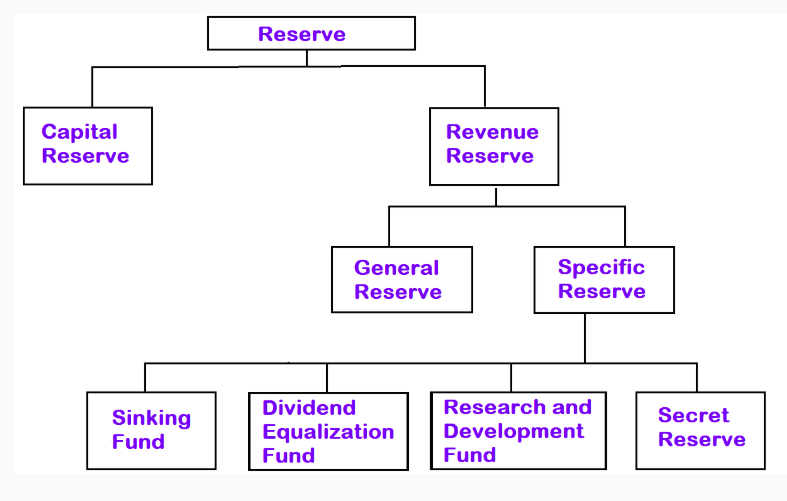

Reserves can be broadly classified into two main categories: Revenue Reserves and Capital Reserves.

1. Revenue Reserves

These reserves are created from the company’s net profits and can be used for future operational needs, expansion, or dividend distribution. They include:

a) General Reserve

- A reserve created without any specific purpose, providing financial flexibility.

- Example: A company sets aside a portion of profits as a general reserve to cover future uncertainties. Consequently, this helps in strengthening the company’s financial position.

b) Specific Reserves

- These reserves are allocated for specific purposes and cannot be used for general business needs.

- Example: A Dividend Equalization Reserve is maintained to ensure consistent dividend payouts. Thus, shareholders receive stable returns even in fluctuating business conditions.

c) Retained Earnings

- The accumulated profits that a company reinvests in its business rather than distributing as dividends.

- Example: A tech startup retains earnings to fund future research and development. As a result, the company can focus on innovation and growth.

2. Capital Reserves

Capital reserves are created from capital profits, which arise from non-operating activities such as asset revaluation or issuing shares. These reserves are typically used for long-term purposes and not for dividend distribution.

a) Share Premium Reserve

- The amount received over and above the face value of shares issued.

- Example: If shares with a face value of $10 are issued at $15, the extra $5 per share goes into the share premium reserve. Consequently, this enhances the company’s capital base.

b) Capital Redemption Reserve

- Created when a company repurchases its own shares or redeems preference shares.

- Example: A company repurchases 1,000 shares from its shareholders and transfers the equivalent amount to this reserve. This, in turn, ensures compliance with financial regulations.

c) Revaluation Reserve

- Maintained when a company revalues its fixed assets.

- Example: If a company’s land value appreciates from $1 million to $1.5 million, the $500,000 difference is recorded in the revaluation reserve. Therefore, this ensures the balance sheet reflects the true value of assets.

What is a Provision?

A provision is an amount set aside by a company to cover anticipated expenses or liabilities that may arise in the future. Unlike reserves, which are allocations of profit, provisions are charges against profit, reducing the company’s net earnings. Hence, provisions help businesses prepare for known liabilities and potential risks.

Examples of Provisions

- Provision for Bad Debts: An amount set aside to cover potential non-payment by customers. Consequently, this prevents unexpected financial losses.

- Provision for Depreciation: Funds allocated for the gradual reduction in asset value. This ensures that financial statements present an accurate picture of asset worth.

- Provision for Taxation: Estimated tax liability set aside before the actual tax payment is due. As a result, companies can avoid last-minute financial strain.

Difference Between Reserves and Provisions

| Feature | Reserves | Provisions |

|---|---|---|

| Purpose | Created to strengthen financial position and meet future needs | Created to cover expected expenses or liabilities |

| Source | Derived from net profits | Deducted from current profits before determining net profit |

| Mandatory | Not always mandatory, except statutory reserves | Generally mandatory to meet expected obligations |

| Impact on Profits | Allocated from profits after tax | Deducted before determining net profit |

| Usage | Used for general or specific future needs | Used for covering specific liabilities or expenses |

Conclusion

Reserves and provisions in accounting both play a vital role in financial planning and risk management. While reserves are allocations from profit to strengthen financial stability, provisions ensure businesses are prepared for anticipated liabilities. Therefore, understanding their differences helps businesses manage finances effectively and comply with accounting standards.

You’ve learned about provisions and reserves; now take the next step by reading our post on Understanding Depreciation: Definition, Types, Importance, and Examples.

[…] of Final Accounts: A Complete Guide with Examples Reserves and Provisions in Accounting: Meaning, Types, and Key Differences Understanding Depreciation: Definition, Types, Importance, and Examples Mastering the Trial […]